WeP GST search provides you with a free GST Number Search tool. GSTIN search is available with a single click. Through our tool, you may check your GST number and perform GSTIN Verification.

A GST number check verifies the legitimacy of a registered taxpayer. Through our website's GSTIN search function, you may simply identify a phoney and invalid taxpayer. With GST verification, you may claim the right input tax credit, which cannot be certified with an inaccurate GST number. The WeP GST GSTIN search toolbar is a straightforward and free-to-use utility. GST verification is critical to ensuring taxpayer validity, ensuring that tax collected travels through the GST supply chain and that cascading of the tax effect is prevented.

What is a Goods and Services Tax Identification Number (GSTIN)/Goods and Services Tax Number?

GSTIN, or Goods and Services Tax Identification Number, is a unique 15-digit alpha-numeric PAN-based code assigned to each Goods and Services Tax registered person (GST). This GST number is issued to the GST taxpayer together with the GST registration certificate, and it also serves as a tracking number for registered taxpayers. The GST No Check tool enables you to do GST No Search and determine your GST in India using your HSN code.

Why is GSTIN or GST Number verification required?

A GST Number, also known as a Goods and Service Tax Identification Number (GSTIN), is critical since it enables the authentication of a GST-registered taxpayer. There are numerous instances of persons manipulating GST numbers (GSTINs) in order to escape taxes. Additionally, the GST Number Search function on the WeP GST Search Tab will assist you in achieving transparency in all business information and ensuring that you are completing the correct GST Returns for each tax month . The GSTIN verification will also assist you in claiming the Input Tax Credit (ITC) that you may forfeit if your GSTIN is forged or erroneous.

GST Number Verification function or Verifying the GSTIN is important to ensure that the appropriate Goods and Service Tax taxes are collected. Additionally, it is an opportunity to contribute to nation-building and the establishment of a transparent tax system.

The GST Number Search Tool: How to Use It

In the GST Number Search box below, enter a valid GSTIN number.

To begin, click the "Search" button. If the GSTIN is accurate, the following information can be verified:

- The business's legal name

- Name of the Business

- State Jurisdiction State Jurisdiction Centre Jurisdiction

- Date of incorporation Business structure – corporation, sole proprietorship, or partnership

- Regular taxpaying individual or composition dealer GSTIN Cancellation Date (if applicable)

What are the WeP GST Search Tool's Features?

Authenticity of GSTIN

Instantly verify GSTIN online

GSTIN or Goods and Services Tax Identification Number structure

Authenticity of GSTIN:

There may be instances where a supplier attempts to deceive customers by misusing the GSTIN. It is required to verify the supplier's GSTIN's authenticity and validity. At WeP GST , the GST Verification tool and GST Calculator are a one-stop shop for all your needs.

Identifying Fake GSTIN

There may be instances where a provider supplies items to customers using a fictitious GSTIN ID. In this instance, the supplier may collect tax from the recipient in the form of CGST+SGST/UTGST or IGST but will not pass it on to the government. Additionally, there may be instances where an individual may claim Input Tax Credit (ITC) by producing bogus/false inward invoices in order to avoid paying tax on goods that were never supplied.

As a result, this may adversely affect the customer's or receiver's interests and may also have a significant influence on government income. To address such situations, the recipient should verify and validate the GSTIN of a new supplier in order to ensure timely GST Verification and GST Compliance . Below, you may check your GSTIN status using the WeP GST Tool.

Instantly Verify Your GST Number Online:

The GST Search Tool is a completely online tool that assists in GST number verification and is accessible via your smartphone with a single click. The following methods are available for verifying your GSTIN online:

- As seen above, input the right GSTIN or GST Number to be enquired for in the search tab and click on Search and Verify GST Number to obtain the necessary GSTIN information or status.

- You can even go to the Government GST website and verify there as well but it may be slow due to the server load where as our tool is faster.

The GSTIN Verification tool retrieves data directly from the Government of India's GSTN and presents the results of a GSTIN search. It's as simple as conducting a Google search.

Structure of the GSTIN / GST Number:

Additionally, it has been observed that tax evaders have developed novel methods for evading taxes from individuals and ultimately duping consumers and the government. They simply substituted a fictitious alpha-numeric code for the GSTIN heading to mislead consumers, which unmistakably resembled a GSTIN. It is also critical to understand how a GSTIN is built in order to detect any fraud.

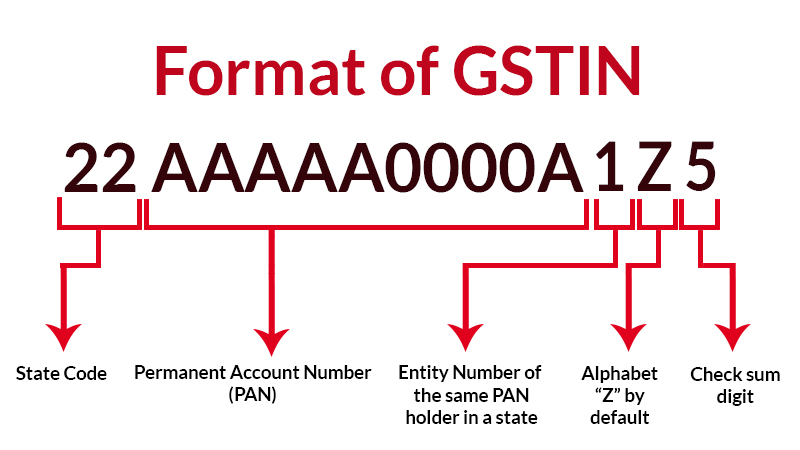

Now, let us examine what a 15-character GSTIN or GST Number reveals:

- The first two digits represent the unique state code assigned by the 2011 Indian Census. For example, Karnataka State Code is 29.

- The next 10 characters are the taxpayer's PAN number.

- The 13th digit represents the taxpayer's registration number along with the related PAN number.

- The 14th digit "Z" is assigned to everyone by default and currently does not symbolise anything.

- The fifteenth digit is the check digit; it may be an alphabet or a numeric value.

Knowing the above bifurcation can also come in handy if you're ever in doubt about the GSTIN's legitimacy while paying at a local merchant's cash counter.