GST Notification

Get Latest updates on Goods and Service Tax, e-Invoice and e-Way bill

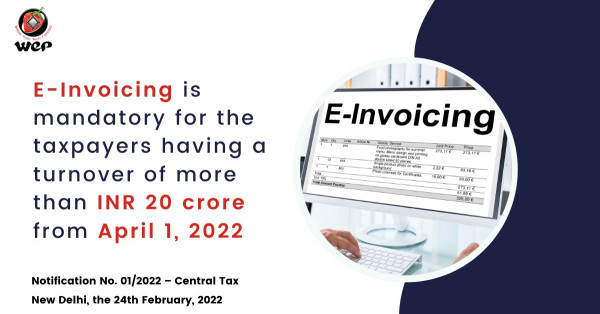

e-Invoicing Mandatory for companies with turnover 20 Cr & above from 1St April 2022

e-Invoicing Mandatory for 20 Cr+ Revenue Companies from 1St April 2022...

Aadhaar authentication is compulsory under GST w.e.f. 01.01.2022

Aadhaar authentication is compulsory under GST w.e.f. 01.01.2022...

Last Date Extension for Annual GST Return (GSTR 9/ 9A/ 9C) for FY 2020-21

Notification No. 40/2021 – Central Tax New Delhi, the 29th December 2021...

Central Goods and Services Tax (Eighth Amendment) Rules, 2021

Notification No. 38/2021 – Central Tax New Delhi, the 21st December, 2021...

Amendment of Finance Act, 2021

Notification No. 39/2021 – Central Tax New Delhi, the 21st December, 2021 ...

Amendment of the Central Goods and Services Tax Rules, 2017

Notification No.37/2021 – Central Tax New Delhi, 01st December, 2021...

Extension of due date of furnish GSTR 1 for April 2021

Notification No. 12/2021 – Central Tax New Delhi, the 1st May, 2021...

B2C Dynamic QR code Notification No. 06/2021

Notification No. 06/2021 – Central Tax...

E-invoicing applicability from 1st April 2021 for more than 50 Crore turnover companies

Notification No. 05/2021 – Central Tax New Delhi, the 8th March, 2021...

Extension of Due date of filing annual return GSTR 9 (FY 2019-20) - Notification No. 04/2021

Notification No. 04/2021 – Central Tax New Delhi, the 28th February, 2021...

Extension of Due date of filing annual return (FY 2019-20)

Notification No. 95/2020 – Central Tax New Delhi, the 30th December, 2020...

.png)